The marijuana legalization movement is often described as a state-level experiment—and one aspect of its implementation that’s garnering more attention is how legalized jurisdictions approach cannabis taxes in different ways.

Pew Charitable Trusts has been monitoring taxation in the legal industry and released a report on Monday that explains the challenges of establishing effective tax schemes and accurately projecting revenues, especially considering that experts don’t have a sizable body of historical data on which to base predictions like they do for alcohol and tobacco.

That said, there are some lessons to be taken from recent years since early legalizers implemented their respective programs.

Because tax rates differ significantly for marijuana businesses and consumers depending on the state, revenue from cannabis sales has varied, leaving policymakers in a flux as they work to meet budget goals and predict future trends, Pew reported.

Revenue was 40 percent higher in the first six months of sales than Nevada anticipated, for example, while sales in California were 45 percent lower than initially projected.

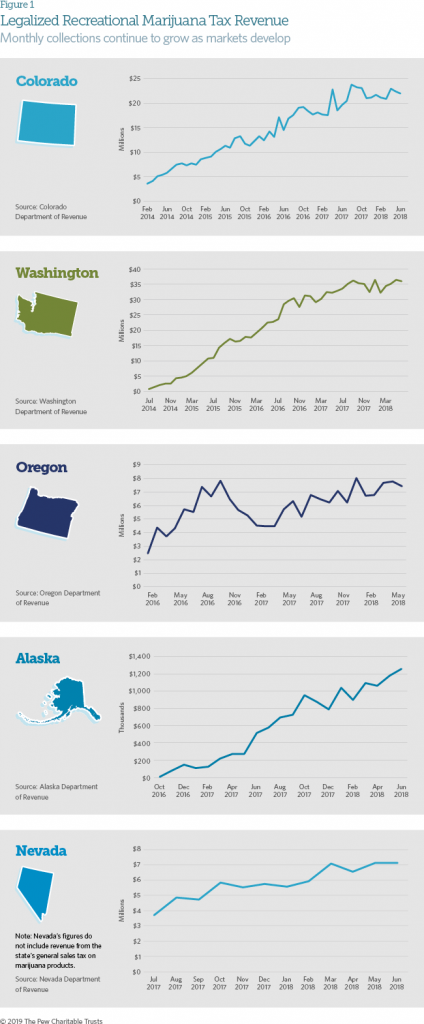

Here’s a breakdown of marijuana tax revenue in five adult-use states:

Via Pew.

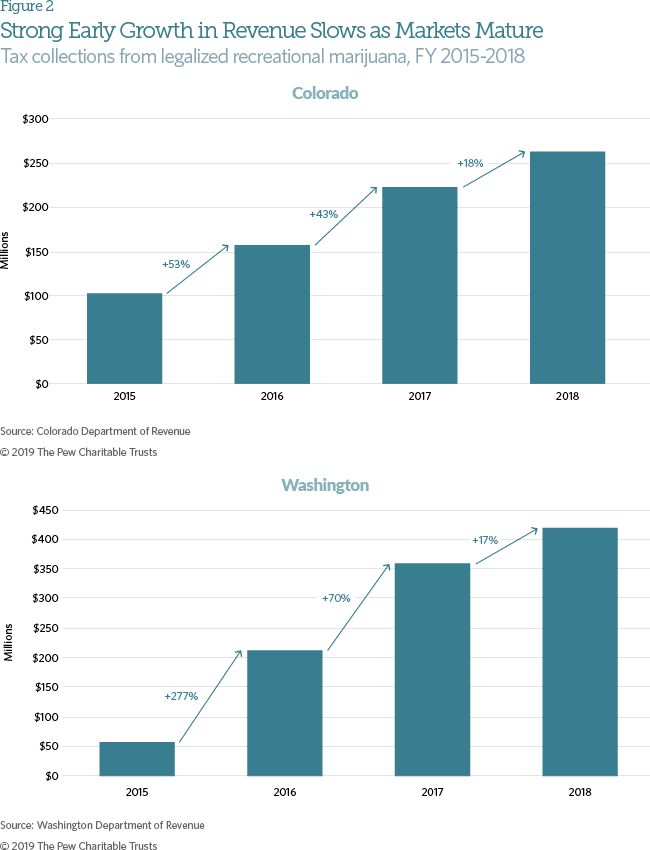

Pew also observed that revenue growth is slowing in Colorado and Washington, the first states to legalize for recreational use, as the market evolves.

Marijuana tax revenue growth in Washington state https://pew.org/2ZaPtER

• 2015 to 2016: 277%

• 2016 to 2017: 70%

• 2017 to 2018: 17%

“Supporters of legalizing recreational marijuana expected a new revenue source for states, but market uncertainties continue to challenge revenue forecasters and policymakers,” Pew concluded. “The difficulty in forecasting revenue is compounded by the fact that states have only recently begun to understand the recreational marijuana market: the level of consumer demand for recreational marijuana products, the types of users and how much they might pay for the drug, and competition with the black market.”

“States have learned some lessons but continue to grapple with unknowns.”

In order to prevent budget shortfalls that could impact funding for certain programs, policymakers should take caution and bear in mind the differences “between marijuana revenue’s short-term growth and long-term sustainability.”

“While these new dollars can fill immediate budget needs, they may prove unreliable for ongoing spending demands,” Pew said. “Policymakers should look to other, more familiar sin taxes for lessons on how to manage marijuana tax revenue most effectively.”

Recent Comments